Breakeven

Have you ever wondered why when you work for yourself, it’s so hard to take long holidays?

Reason is, there is a double whammy effect whenever you’re taking an extended holiday. Not only does the income dry up, but the business overhead does not go away.

This is just a single example of why it’s vital to know your business’ breakeven.

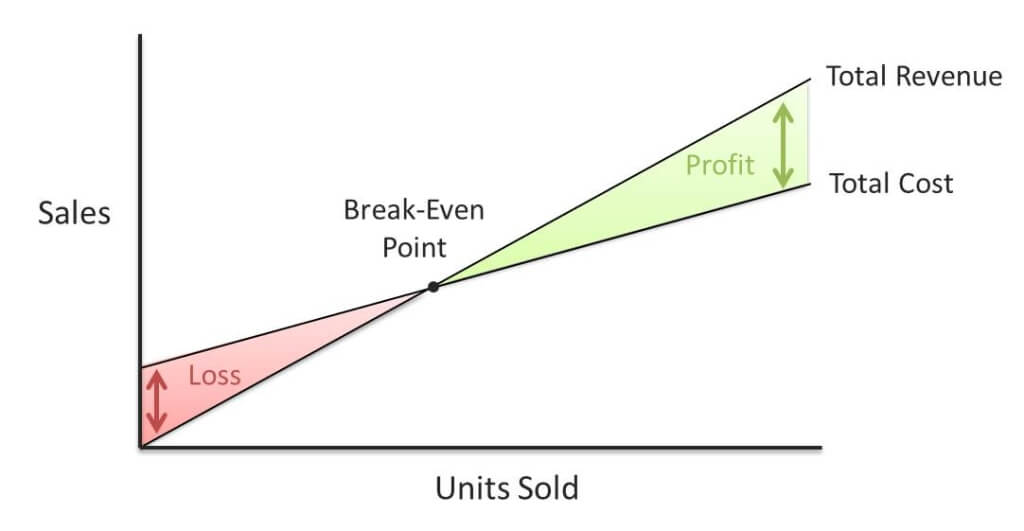

Your break even point is the amount of income you need to produce in order to cover your fixed costs. Or put in other words, the money required to operate your business, before you even get out of bed.

Knowing your breakeven can help you plan for a holiday or the unforeseen and can be factored into your

cash flow management.How to work out your business’ Breakeven in 3 steps.

- To calculate, begin by taking a set of your latest accounts, preferably prepared under real time accounting practices so they are up to date.

- Next, you need to sort and separate your fixed expenses from variable and discretionary expenditure.

Fixed expenses: Examples of fixed business overhead are lease payments, annual insurances and registration on the business vehicle. Other examples may include rent or repayments and fixed outgoings like land tax, rates and water and electricity connection fees, and monthly bank account and maintenance fees. Variable expenses: Variable expenses would conversely include tolls, petrol and parking for the motor vehicle, water and electricity meter usage and merchant fees on credit card and bank account transactions. These variable numbers will depend entirely on what you use. Similarly, wages and salaries for permanent staff and permanent part-timers are fixed, casuals are variable. If the owners are dependent on receiving their wages or drawings, then include these as fixed costs too.

- Now, the fun part. Simply total the fixed costs for a given period, and divide or multiply appropriately to calculate your daily, weekly, monthly or yearly overhead.

The amount you arrive at is how much you need to generate in fees or gross profit (if trading goods) just to keep the doors of your Business open for trading.

If you’re suspending operations temporarily, like the annual Christmas shutdown or to take that long overdue and well-deserved break, you are now in a position to plan.

The figure you came up with as your break even, is the amount you will need to accumulate to cover the period of business inactivity and be money-worry free.

It’s also very useful to be mindful of this figure when setting pricing, bonuses, staff incentives etc..

Conversely, you might think twice before committing to that “nice to have” subscription. You would be surprised at how the small expenses here and there add up.

As the old saying goes, “Watching the pennies will take care of the pounds”.

If you are a start-up, knowing your breakeven and keeping it to a minimum is critical until such time as you can establish regular cash flow to cover overhead.

When things go wrong…

Your breakeven is also very useful in determining business overhead insurance required for your specific situation.

You can use you breakeven figure to negotiate a level of cover sufficient to keep your business on life support, while you take time out to recover and run your business worry free from whatever mishap has befallen you.

Good Business Overhead Insurance, coupled with income protection, could be the difference between staying in or going out of business.

Knowing your Breakeven comes down to this: knowledge is power and knowing your breakeven gives you the power to manage costs, work smarter and ensure your business has the insurance coverage it needs to survive an unforeseen adverse circumstance.

If you are interested in finding out more about business overhead insurances and discuss your specific circumstances, contact John Scott on 0433 402 005 or john.scott@fraserscott.com.au at our sister firm Fraser Scott Financial Advisory P/L and quote promo code “Breakeven” for a complimentary Statement Of Advice.*

*Offer valid until March 2016The information contained in this article is General Advice. It does not take into consideration your personal or financial circumstances, needs and objectives and does not constitute a specific recommendation.